Rwanda’s formal external trade shrank notably in the second quarter of 2025, as both exports and imports dropped against the backdrop of slowing global demand and tighter domestic conditions, according to the latest data from the National Institute of Statistics of Rwanda (NISR).

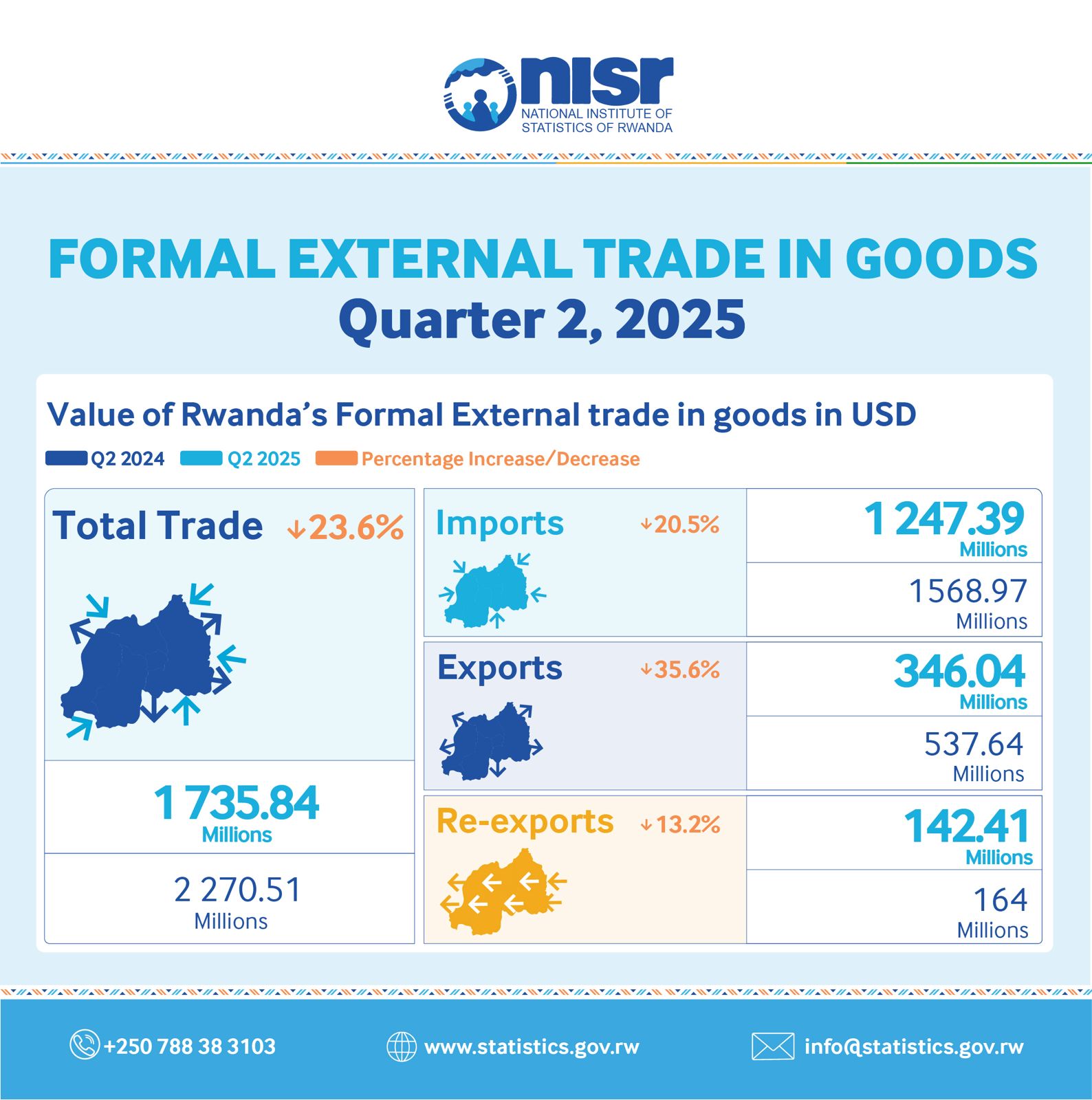

The quarterly report shows that the total value of formal external trade in goods reached $1.74 billion, representing a 13% decline compared to the first quarter of 2025.

Domestic exports were hit hardest, recording $346.04 million in Q2 2025, a 35.6% decrease from the same period in 2024 and 28% lower than in Q1 2025.

This sharp contraction raises concerns about Rwanda’s ability to sustain foreign exchange earnings, particularly from traditional export commodities.

The fall may be linked to weaker international demand, falling commodity prices, and supply constraints. Analysts note that if the trend persists, it could widen Rwanda’s trade deficit and weigh on economic growth.

Imports amounted to $1.25 billion, reflecting a 20.5%year-on-year fall and a 9.6%decline from Q1 2025. While reduced imports can ease foreign exchange pressures in the short term, they also signal subdued domestic demand and potential slowdowns in industrial activity, as many imports consist of capital goods and raw materials essential for production.

China, Tanzania, India, Kenya, and the United Arab Emirates remained Rwanda’s top suppliers, underscoring the country’s reliance on a few trading partners for critical imports.

Re-exports show resilience

According to NISR’s latest data, re-exports stood at $142.41 million in Q2 2025. Although this figure is 13.2% lower than the same quarter in 2024, it represents a 5.2% increase from the previous quarter, indicating resilience in regional trade flows.

The Democratic Republic of Congo (DRC) continues to dominate Rwanda’s re-export market, accounting for 94.55% of the total. Other key destinations included Ethiopia, the UAE, Burundi, and Germany.

The most re-exported goods were food and live animals ($51.6 million) and mineral fuels, lubricants and related materials ($31.9 million).

Trade balance outlook

The contraction in both exports and imports reflects Rwanda’s vulnerability to external shocks and domestic constraints. With exports falling more steeply than imports, the trade deficit remains a structural challenge.

Economists point to the need for diversification of export products and destinations, investment in value addition for key commodities, and policies to enhance competitiveness in international markets.

At the same time, stabilizing domestic demand and ensuring access to essential imports will be crucial for sustaining industrial activity.

Policy and business implications

For government and businesses alike, the latest trade figures underline several priorities

Diversifying markets – expanding beyond current export destinations such as the UAE, DRC, and Belgium to new regions could reduce risks tied to over-dependence.

Boosting local production – encouraging industrialisation and agro-processing would help reduce reliance on imports while creating higher-value exports.

Strengthening trade facilitation – improved logistics, infrastructure, and customs efficiency could lower costs and make Rwandan exports more competitive.

Regional trade leverage – given the dominance of the DRC in re-export markets, Rwanda could strategically leverage regional trade agreements to consolidate gains.

Rwanda’s Q2 2025 trade performance paints a sobering picture of a country grappling with falling export revenues and subdued import demand. While the resilience of re-exports offers some relief, the overall decline underscores the urgent need for structural reforms in trade and industry.

The coming quarters will test Rwanda’s ability to adapt—balancing the immediate pressures of a narrowing trade environment with long-term strategies aimed at building a more diversified and resilient economy.