Rwanda’s government announced on Thursday it will cut down customs tax on electric, hybrid and transport cars, as well as taxes on imported foodstuffs and construction machinery.

The move was announced by the Finance and Economic Planning Minister Dr Uzziel Ndagijimana during the presentation of the national budget for the fiscal year 2023/2024 to joint chambers of the parliament.

Rwanda, like many other countries especially in the developing world, was severely hit by the effects of Covid-19, and the war in Ukraine, among other global challenges.

To ease this pressure on the economy, the country is revising its customs tax to respond to the soaring prices of almost every imported good.

The country will spend Rwf5 trillion in the 2023/2024 fiscal year.

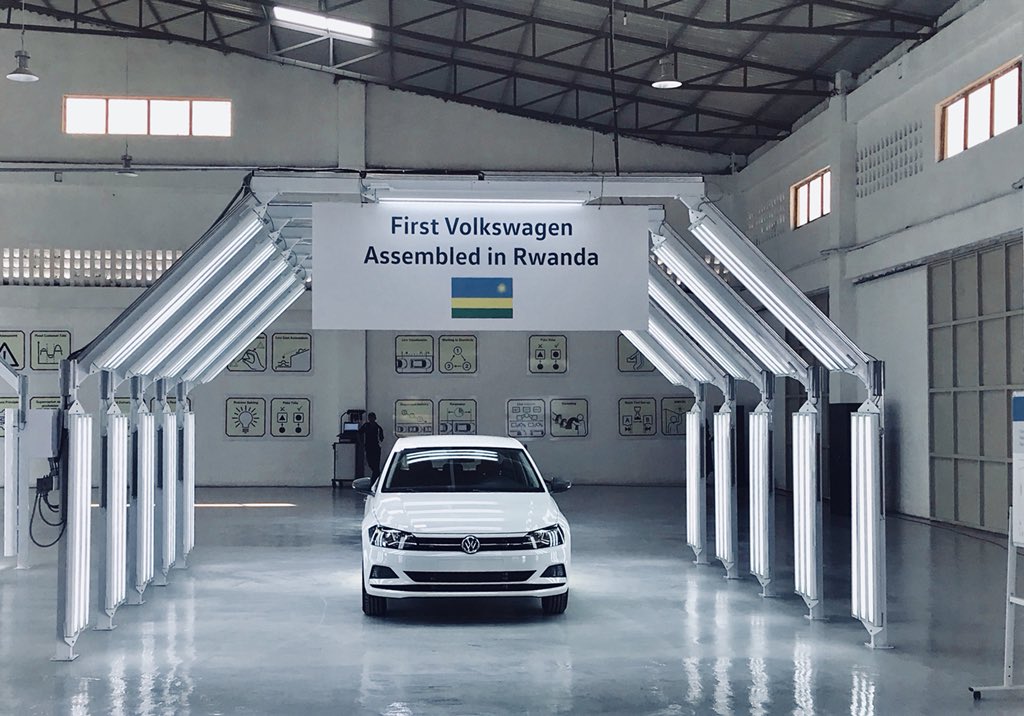

Addressing the parliament on Thursday during a budget presentation, Finance Minister Dr Uzziel Ndagijimana said that the government has removed import tax for electric cars/motorcycles and hybrid cars.

Despite moving to curb the rising environmental threats, the Minister added that the country also looks forward to alleviating the burden of fuel costs that keep rising.

The country further adjusted import taxes on foodstuffs. For instance, rice will be taxed at 45% or $ 345 per ton compared to 75% in other East African Community (EAC) member countries.

Cooking oil whose costs have been skyrocketing has also been reviewed downward from 35% to 25%.

On other commodities, the tax on sugar was slashed from 100% to 25%, while goods from army shops which have been paying 25% were completely exempted.

In 2012, Rwanda passed a policy to establish an army shop which sells duty-free goods to the beneficiaries aiming at improving the welfare of Armed Forces members and their immediate families.

The new custom tax review saw transport vehicles, and road construction machines exempted, against the previous 10% tax payment. Other cars from public transport or transport of goods saw their tax reviewed downward in accordance with their carrying capacity.

For instance, vehicles with a carrying capacity of between 5 to 20 tons had their tax of 25% exempted, but those that go beyond 20 tons, will pay 20% instead of the existing 25%.

In public transport, the buses that carry more than 25 passengers will pay 10% instead of the existing 25%, while those that have 50 places and beyond were exempted.

Also exempted are heavy machinery and the garment industry machinery, ICT equipment, raw materials, and banking equipment used in transactions.

In the current budget, however, second-hand clothes and shoes saw their tax reviewed upward. Rwanda remained resilient in encouraging citizens to buy either brand new or from the local apparel industry.

As a result, second-hand clothes will be taxed at $2.5 per kilogram, instead of the current $ 0.5 per kilogram while second-hand shoes will be taxed at $ 5 per kilogram, instead of $ 0.4 per kilogram.